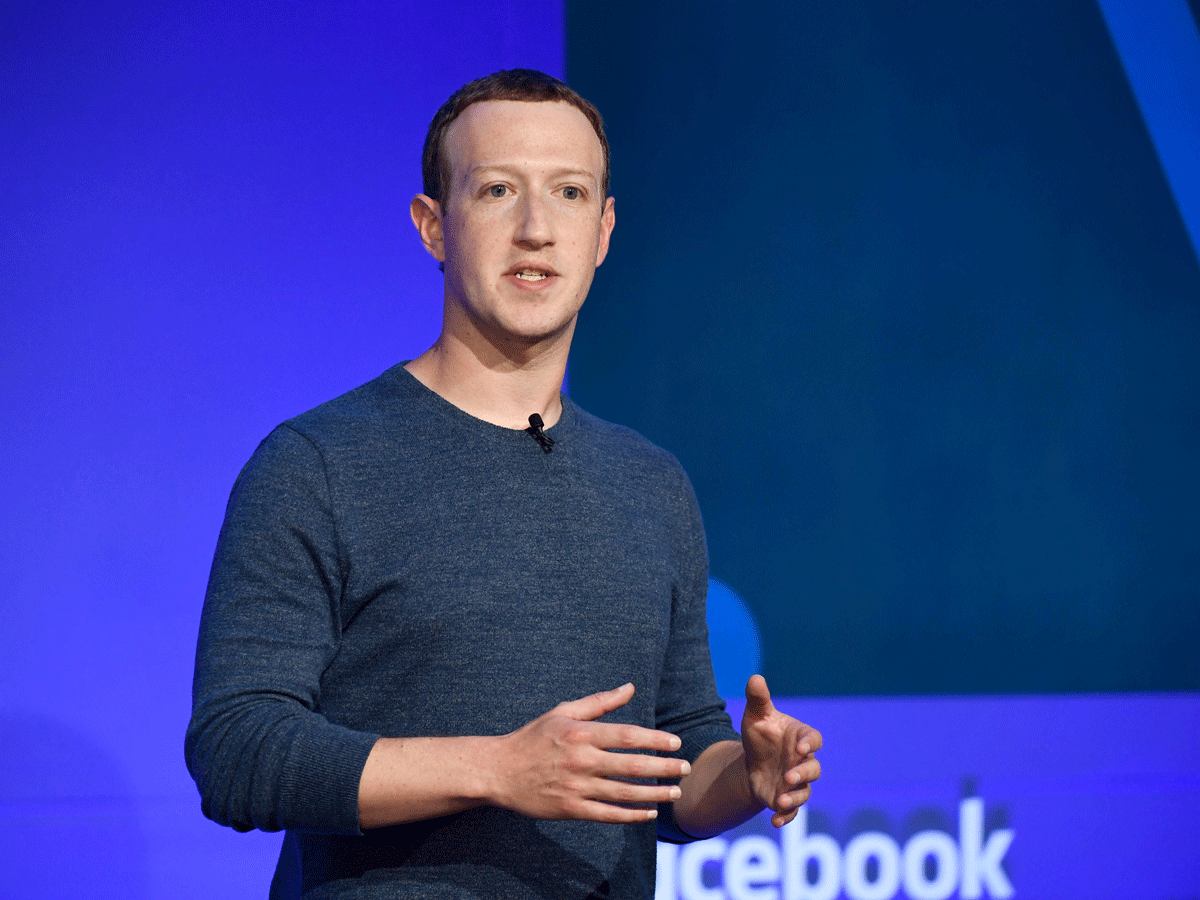

Mark Zuckerberg’s fortune increased by $44 billion in the first five months of the year. Photo: Bloomberg. In 2022, Meta’s CEO Mark Zuckerberg focused heavily on the metaverse, particularly investing in virtual reality to lead the field.

However, the metaverse spending proved excessive, leading to a staggering decline of $100 billion in his fortune within just one year. This was a concerning downturn for a technology CEO who was once ranked as the 3rd richest billionaire in the world.

By 2023, Mark Zuckerberg shifted his focus back to the real world by initiating mass layoffs at Meta and aiming to become a Twitter rival.

This change in strategy resulted in a rebound for Meta’s stock and a remarkable increase of $44 billion in Mark Zuckerberg’s fortune in the first 5 months of that year alone. Most of his wealth comes from the number of shares he holds. This surge in personal wealth marks the largest growth in his fortune, according to Bloomberg.

Mark Zuckerberg’s fortune experienced the largest growth in personal wealth according to Bloomberg.

Despite a slight drop on May 19 on the New York Stock Exchange, Meta’s stock remains one of the S&P 500’s best growth stocks in 2023 due to the efficient optimization strategy proposed by CEO Mark Zuckerberg.

Mark Zuckerberg’s fortune surged thanks to the recovery in Meta’s share price. Year-to-date, the group’s shares have increased by 102%, currently at $245.64 per share, leading to the billionaire’s fortune doubling, reaching $89.9 billion. Additionally, he returned to the top 20 richest billionaires in the world.

According to Bloomberg, Meta, the company behind Instagram, is planning to launch a new application that will directly compete with Twitter in June. Unlike Instagram’s focus on photo sharing, this app will be “text-based” and is being tested by celebrities and influencers.

The news application will work independently of Instagram but still allow linking to existing accounts, even compatible with competing Twitter applications like Mastodon. Experts believe that Meta’s habit of imitating features from other apps could lead to a consolidation of the entire experience they are building and developing.

Bloomberg Intelligence analysts suggest that Meta has many winning advantages over Twitter and other smaller social media companies, although they anticipate challenges in pulling Twitter users to its platform.

Loop Capital Markets analysts also predict a positive outlook for Meta’s upcoming revenue and expect the share price to reach $320/share, up sharply from $245.64 USD at the end of the trading session on May 19. They believe Meta’s product will return to its former glory.